Credit rating unions typically have membership limitations you have to meet up with to affix and begin opening accounts or getting out loans. These constraints can be dependant on geographic spot, employer, family membership, Local community involvement and other things.

A cash progress is essentially a brief-expression loan provided by your credit card issuer. When you get out a cash progress, you might be borrowing revenue towards your card's line of credit score. You may typically get a cash advance in a number of alternative ways:

Upstart might cost an origination cost as high as 12%, but good-credit score borrowers might not be charged a single in any respect.

In 2024, the most effective rapidly individual loans present cash the moment a similar working day or the next day immediately after acceptance.

Kiah Treece is a small business operator and personal finance qualified with experience in loans, small business and personal finance, coverage and real estate property. Her aim is on demystifying financial debt to assist individuals and entrepreneurs get control of their fina...

In the U.S., credit scores and credit reports exist to offer information about Just about every borrower to ensure lenders can assess threat. A credit score score is actually a number involving 300 and 850 that represents a borrower's creditworthiness; the upper, the better.

Learn Individual Loans features lower APRs, repayment phrases as many as 7 decades, no origination charges, nationwide availability, and won't involve your Social Security amount to prequalify on its site.

Picking a shorter loan time period and Placing more money down can reduced the curiosity fee a borrower is matter to.

Emily Person Birken BLUEPRINT Emily turned a personal finance author by chance. In 2010, though on maternity depart through the classroom, she found out that her background in Innovative composing, her stint like a highschool Instructor, and her lifelong interest in all points revenue-relevant 29 cash loan built her an in-need freelancer.

There aren't any origination charges, and rates are minimal — Lightstream's lowest APR beats SoFi's marketed most affordable APR by 1 proportion issue. But You will need great credit history to qualify.

Why a Wells Fargo private loan stands out: Wells Fargo claims it may possibly generally produce your funds by the next enterprise day soon after loan approval. You’ll must be an current client for at least 12 months to submit an application for a Wells Fargo personal loan.

Quite a few client loans fall into this group of loans that have frequent payments which might be amortized uniformly above their lifetime. Plan payments are made on principal and desire till the loan reaches maturity (is totally paid off). A number of the most acquainted amortized loans include mortgages, auto loans, student loans, and personal loans.

Ahead of shopping for any loan, it’s a good idea to make use of a loan calculator. A calculator can assist you narrow your quest for a home or car or truck by demonstrating you the amount it is possible to manage to pay monthly. It will help you Assess loan prices and find out how differences in desire fees can have an impact on your payments, Specially with home loans.

Comfort check: Your bank card may have feature benefit checks, which may be utilized to put in writing a Check out to on your own. You can then cash it or deposit it.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Alexa Vega Then & Now!

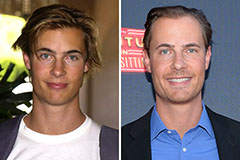

Alexa Vega Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!